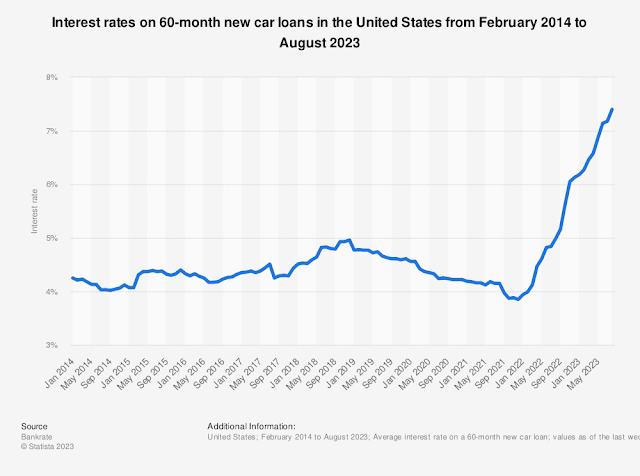

Car loan interest rates in the United States reached over seven percent in June 2023. In the U.S., the interest rate on five-year car loans decreased between 2019 and December 2021, when it reached the lowest value of 3.85 percent. However, the interest rate has soared in the months after that. The average size of new car loans and leasing in the U.S. has risen in the past couple of years, increasing further the burden on borrowers.

How many cars have financing in the United States?

Car financing exists as not everyone who wants or needs a car is able to purchase it outright. A financial institution will then lend the money to the customer for purchasing the car, which must then be repaid with interest. Most new vehicles in the United States are purchased using car loans. It is not as common to use car loans for purchasing used vehicles as for new ones, although more than one third of used vehicles were purchased using loans.

The car industry in the United States

The car financing business is huge in the United States, due to the high sales of both new and used vehicles in the country. Although the sales of cars peaked in the late 1980s and overall dropped since, 2020 saw the lowest number of cars sold since the 1950s. The number of sold cars in 2020, however, still exceeded 3.4 million.